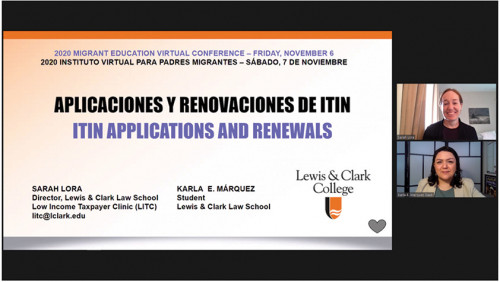

Low Income Taxpayer Clinic

Students Update Migrant Parents on ITINs

“Working on this presentation with Professor Sarah Lora and then having the opportunity to speak to educators and parents in both languages reminded me of why I came to law school,” Karla Márquez ’23 said about creating and interpreting the presentation. “I am passionate about creating opportunities for non-English-speaking communities to access quality legal information.”

LITC Secures Win for Visiting Jamaican Farmworkers

Kevin Fann ’20 and Lauren Faris ’21 worked with Assistant Clinical Professor and Director of the Low Income Taxpayer Clinic Sarah Lora, researching the issue and drafting the protest letter on behalf of the H2-A workers. “We were extremely excited when we learned the IRS decided the case in our favor,” Lora said. “Since this decision is now on record, hopefully it can be used to help similarly situated H2-A workers dealing with the same issue.”

Supporting Business Law and Innovation

More Advocate Magazine Stories

email jasbury@lclark.edu

voice 503-768-6605

Judy Asbury, Assistant Dean, Communications and External Relations

Advocate Magazine

Lewis & Clark Law School

10101 S. Terwilliger Boulevard MSC 51

Portland OR 97219